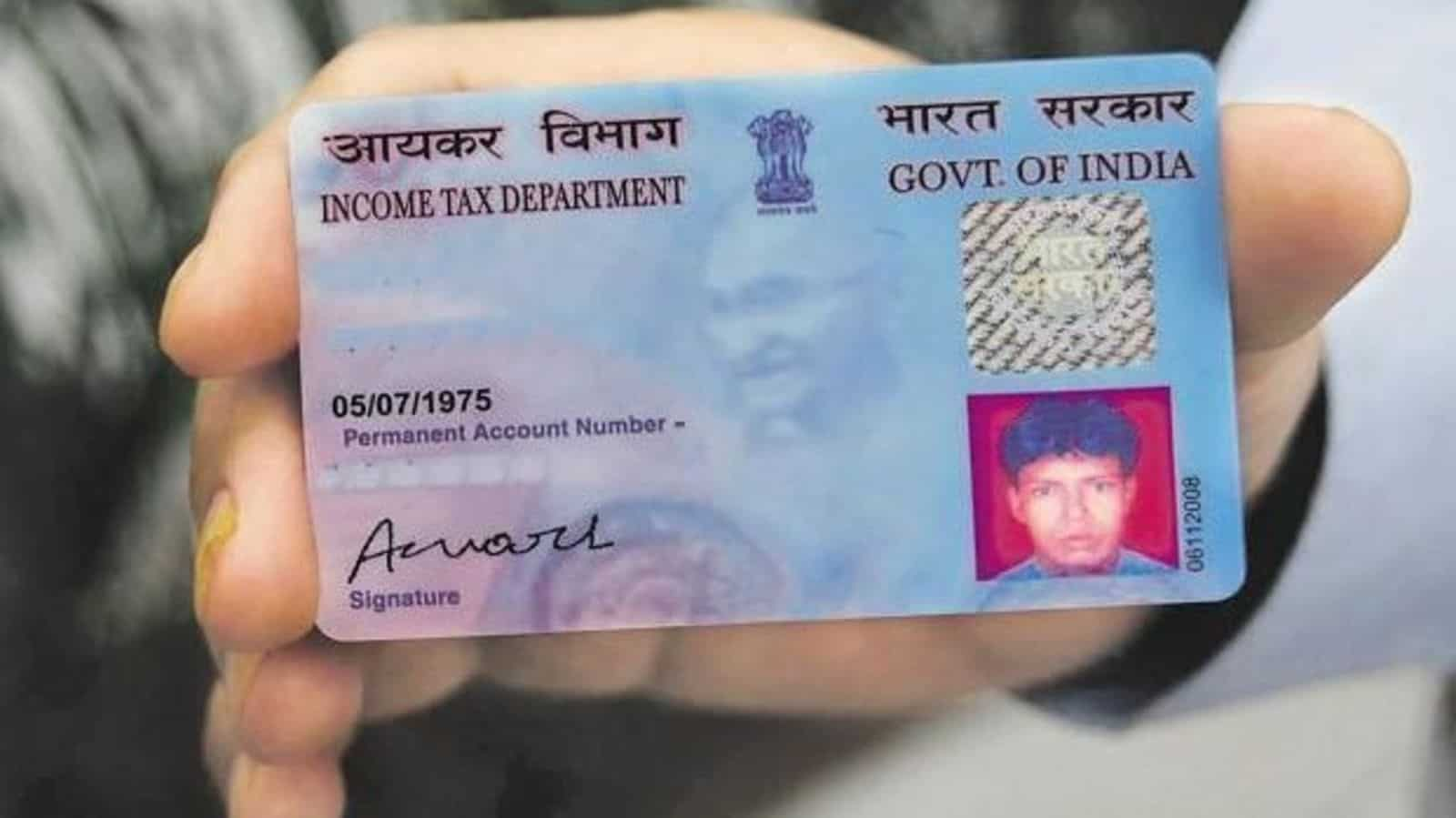

In India, taxes are also collected from citizens’ earnings. The term for this is the income tax. On the other hand, a PAN card is also required for anyone filing income tax in India. Every country resident who pays taxes receives a Permanent Account Number, a 10-digit unique identifying number (PAN). Everyone who pays taxes, including people, businesses, nonprofits, and local governments, needs a PAN card. However, what will happen if a minor’s income is taxable and he does not have a PAN card in this circumstance?

income tax rate

An application for a PAN card can really be made and submitted by a minor. According to the regulations, filing ITRs is not prohibited in India. A minor may also file an ITR if his monthly income exceeds Rs. 15,000. However, in order to file an ITR, you must have a PAN card. The Income Tax Department has not established a minimum age limit for obtaining a PAN card.

income tax

A minor will need to submit income tax in this case if his annual income exceeds Rs. 2.5 lakh, making it taxable, and he also needs a PAN to do so. Minor should apply for a PAN when making investments in their name, naming their child as the beneficiary of those investments, opening bank accounts in their name, or when they receive their first paycheck.

income tax return

PAN applications are submitted on behalf of the minor’s parents or other legal guardians. ITR submission on behalf of the minor is the obligation of the guardian. Since a minor’s PAN does not have his signature or picture on it, it cannot be used as identification. After turning 18 years old, the youngster must file the card update application.

The PAN card for a minor will be created as follows:

- Go to the NSDL website.

- Complete Form 49A and review the guidelines.

- Post images of your parents.

- Along with other requirements, upload the minor’s birth certificate.

- Upload the signature of the parent.

- Pay the charge.

- Press the submit button.

- A number will be provided that can be used to find out an application’s status.

- Within 15 days of successful verification, you will receive your PAN card.

Read More: Sukanya Samriddhi Yojana for girls’ interest rate has remained unchanged

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |

Google News Google News |

Click Here |