The fiscal year is nearly over. Everyone intends to minimize their tax liability. Salaried-class investors can use Section 80C of the Income Tax to save money on taxes. You can receive income tax benefits of up to Rs 1.5 lakh by investing in this. However, if your taxes are still owed after this, you can avoid paying them by making investments under different income tax categories.

NPS will reduce taxes.

Don’t panic if you wish to save taxes and your Section 80C maximum has been reached. Investing in the National Pension Scheme can result in tax savings of up to Rs 50,000. This investment is in addition to the limit of Rs 1.5 lakh under section 80C. This means that you can save tax on total income up to Rs 2 lakh.

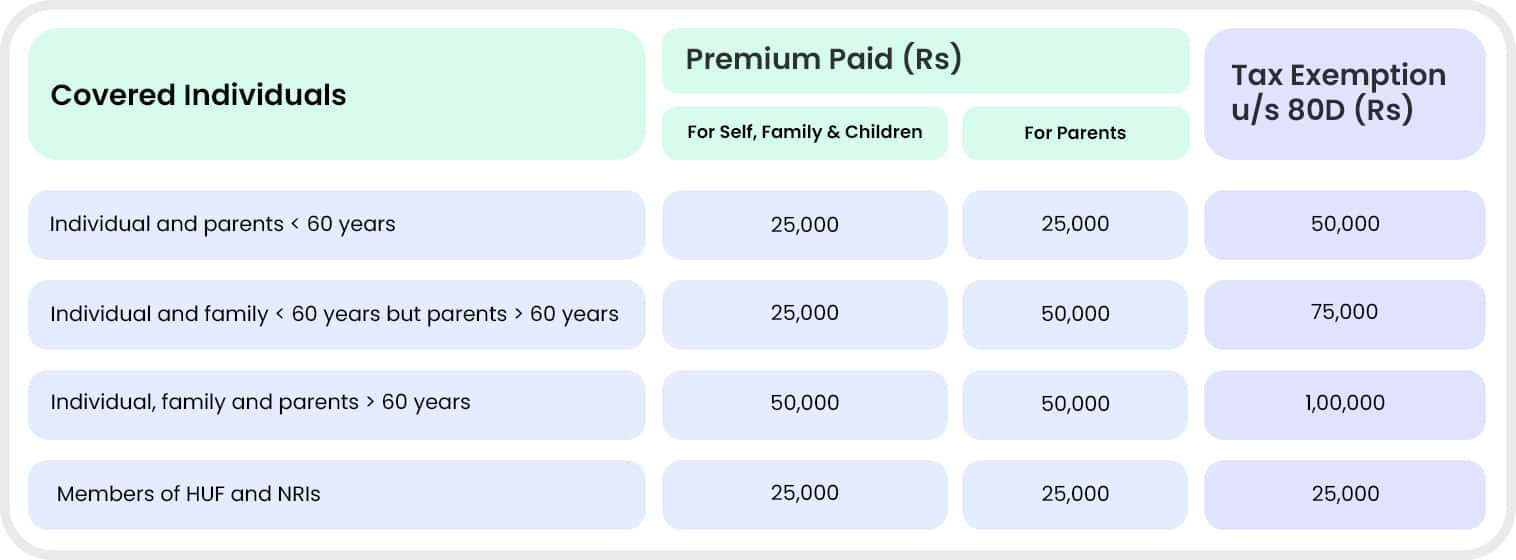

Exemption on Health Insurance

You are eligible for a tax exemption on the health insurance premiums you pay for your family. You can invest up to Rs 25,000 in your spouse’s, kids’, and your health insurance premiums under Section 80D. In addition, you can pay a fee of up to Rs 25,000 for health insurance if your parents are younger than 60. However, this cap is only applicable to elderly citizens’ parents up to Rs 50,000.

Health checkup exemption

Did you know that receiving a health checkup can also result in a tax exemption? You can deduct investigation-related costs under Section 80D. You are eligible to deduct a maximum amount of Rs 5,000. This amount comes within the limit of the total deduction given under section 80D.

Interest-bearing savings account exemption

Interest-bearing savings account exemption

Individual taxpayers and Hindu Undivided Families (HUFs), who are exempt from section 80TTB, can deduct interest income from savings accounts opened in banks, post offices, or cooperative societies under section 80TTA. During the fiscal year, the maximum tax deduction of Rs 10,000 is available.

Donation exemption

If you have given money to someone by Section 80G, you are eligible to deduct the donation amount. However, it should be remembered that this donation cannot exceed 10% of the overall income. Donations are given for the restoration of churches, mosques, and temples that have been authorized by the Central government.

Read More: The GATE 2024 results are now available via this direct link!

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |