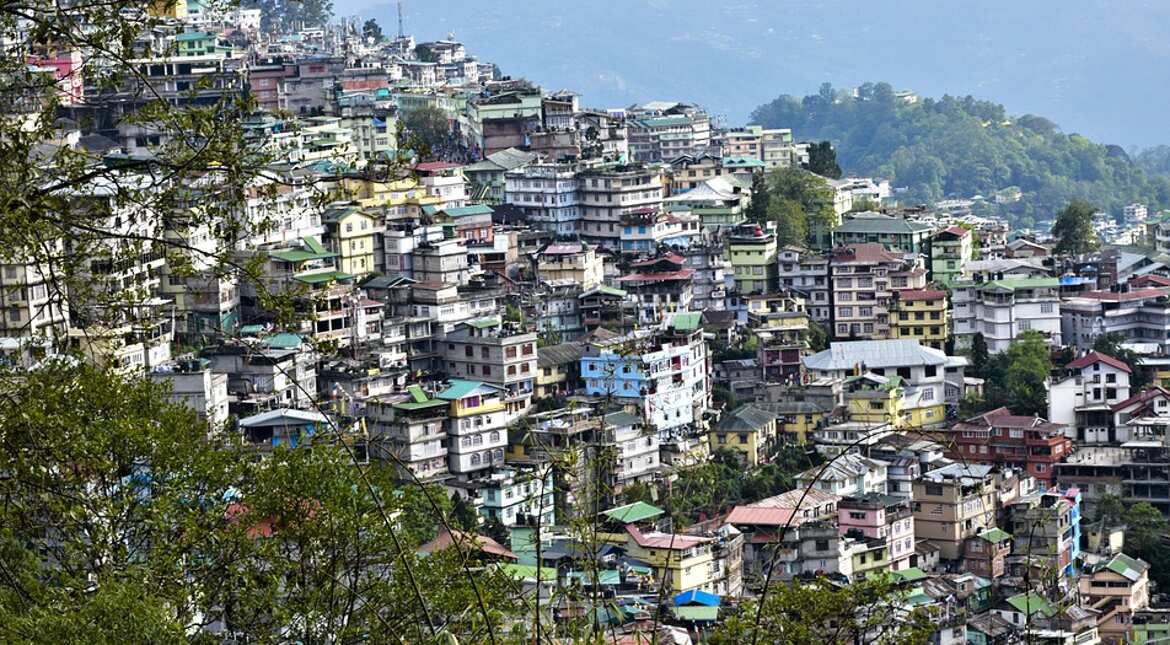

Just a few days ago, Finance Minister Nirmala S Sitharaman announced the budget plan for the financial year 2023-23. In that speech that there would be no tax on incomes up to seven lakhs rupees. A lot of people were thrilled after the announcement however, do you know that there’s a situation like that in India? In India, not one rupee is collected from the general public in income taxes. Yes, you’re correct. If the earnings of people in that state are in millions of rupees, the Income Tax Department does not ever collect one rupee from the state. What is the reason behind this law in Sikkim?

What is the reason for this exemption being granted?

Native residents get discount

The exemption was granted to the first residents of Sikkim in accordance with the Income Tax Act. It is important to note this: the Supreme Court had given a ruling in this case. Since then, approximately 95% of people from Sikkim have benefited from this exemption. Prior to this, the exemption was available only to those who have a Sikkim subject certificate.

Article 371A

We’ll tell you that all states in the Northeast have been granted an exclusive status in accordance with Article 371A. Because of this, residents from other regions of the nation are not allowed to purchase land or properties in this region. Sikkim residents Sikkim are exempted from income tax pursuant to section 10 (26AAA) from the Income Tax Act, 1961.

Read More: All policies fail thanks to this LIC scheme! Investors raise Rs 20,000 per month

![]()

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |