Everyone invests money in many methods today to build their riches. Today, we’ll tell you about a mutual fund program where, with a small investment, you may quickly amass millions. We are all aware of the importance of compounding and how quickly your money grows. Mutual Fund SIP is currently very popular with investors.

What mutual funds will produce profitable returns?

Investors have numerous advantages over time if they make regular, monthly SIP investments. As SIP becomes more and more popular, more businesses are releasing new mutual funds on the market. You should research which mutual funds will provide you with decent returns before you invest. Today, we’ll tell you about a mutual fund that will enable you to acquire Rs 1 crore. Let us outline the fund you will need to select for this:

Mutual Funds – Getting a minimum return of 12%

Check the past returns of any fund you are considering before deciding. You ought to pick a fund that will provide returns of about 12% annually. By contributing Rs. 100 to this kind of fund every day, you can amass a million dollars.

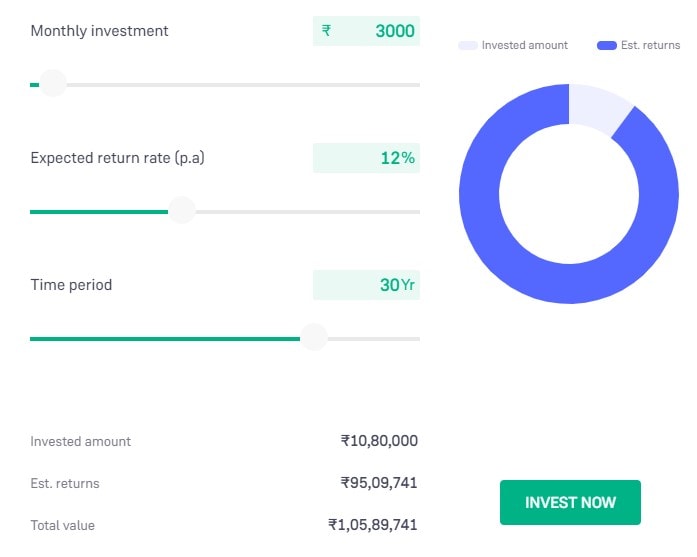

Must make a monthly investment of Rs. 3000

You can easily become a millionaire if you invest Rs 100 each day, or Rs 3000 per month, and if you do this regularly for 30 years. Let us calculate the amount of money you would receive after 30 years using the Groww App’s SIP calculator.

The crore threshold will be reached

For instance, if you deposit Rs. 3000 each month and receive interest on it at a rate of 12 percent each month, your deposit amount and returns will total more than Rs. 1 crore.

If you put away Rs. 3000 per month, your investment will grow to Rs. 10,80,000 after 30 years. Additionally, if you receive a return of 12%, your interest would be Rs. 95,09,741. Your current investment and returns total Rs 1,05,89,741. In addition, if your returns grow at a pace of 13%, you will reach the million-dollar mark in just 28 years.

At your own risk, invest

Let us inform you that there are dangers and good rewards associated with investing in mutual funds. You must invest at your own risk because a rise in the market will raise your money while a decline could result in a loss on your portfolio. Additionally, before making an investment, you should speak with your advisor.

Read more: Good news for promotions before DA, Central Government revised the rules

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |