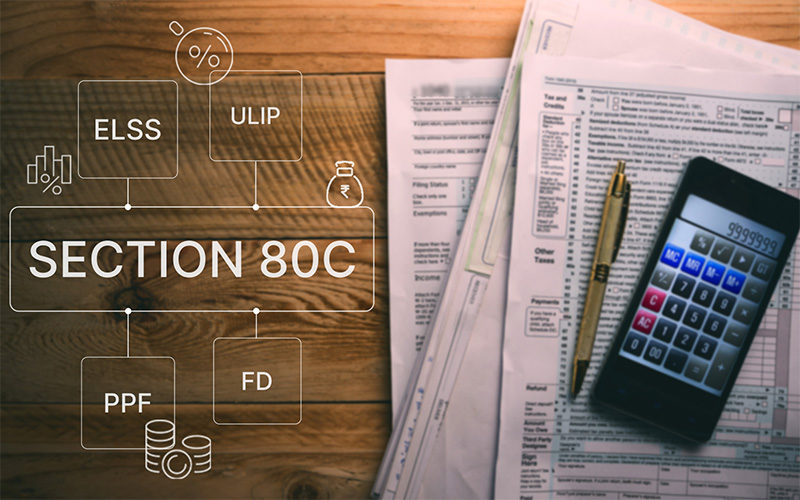

There are only a few days left until March 31 to make tax-saving investments, and taxpayers are considering some well-liked small savings plans that qualify for section 80C deductions. These programs include the Senior Citizens Savings Scheme (SCSS), National Savings Certificate (NSC), Sukanya Samriddhi Account (SSA), Public Provident Fund (PPF), and five-year post office time deposits. Although these programs provide safe returns and high interest rates, keep in mind that interest rates are subject to quarterly reviews and that individuals who choose the previous tax system can receive tax benefits of up to Rs 1.5 lakh under section 80C. You should only invest in these securities if your liquidity needs are met because they have lock-in durations of more than five years.

Public Provident Fund (PPF)

This well-liked option, which is accessible to both salaried and self-employed individuals, has an interest rate of 7.1 percent; however, it is subject to quarterly evaluations by the finance minister. In a financial year, you can invest as little as Rs 500 and as much as Rs 1.5 lakh. Premature withdrawals are permitted, however, it has a lengthy maturity time of 15 years (not including the financial year of account opening). If it gets close to maturity, it can be prolonged for an additional five years.

After five years, you can only withdraw one time in a fiscal year (not including the year the account was opened). For instance. If you started your account between 2017 and 2018, you are permitted to withdraw one (1) time in the years 2023-24. The maximum premature withdrawal permitted is 50 percent of the balance at the end of the fourth preceding financial year or the end of the preceding year, whichever is lower.

Sukanya Samriddhi Account (SSA)

Sukanya Samriddhi Account (SSA)

This plan offers the highest compound annual interest rate of all the small savings options, at 8.2 percent per year. The minimum amount you can invest is Rs 250, and the most is Rs 1.5 lakh. Additionally, the interest earned is tax-free. This account can be opened by a guardian of a girl child under 10 years old to save money for her education. For the next fifteen years, he or she may keep making the deposit. It won’t mature, though, until the girl kid becomes 21.

If the girl marries after turning 18, the proceeds can also be fully refunded. These cancellations are possible at the time of the wedding; they won’t be accepted after month before and three months after the girl gets married. The rules, though, allow partial, premature withdrawal of up to 50 percent of the balance at the end of the preceding financial year, once the girl turns 18 or passes her tenth standard examinations.

National Savings Certificate (NSC) – VIII issue

National Savings Certificate (NSC) – VIII issue

These instruments have a five-year lifespan and are currently less common than they were in the past. A minimum deposit of Rs. 1,000 is required. They currently provide a 7.7% interest rate that is paid at maturity and is compounded annually. Except under certain circumstances. Such as the death of the account holders, and forfeiture by a pledgee (a gazetted officer). In court orders, premature closure is not allowed. By completing an application at your neighborhood post office. You can pledge or transfer your NSC as security. A letter of acceptance from the pledgee must be included.

The SCSS, or Senior Citizens Savings Scheme

The SCSS, or Senior Citizens Savings Scheme

This scheme has a five-year lock-in term and is available to investors over the age of sixty. The highest deposit amount is Rs 30 lakh, with a minimum of Rs 1,000. Under section 80C, these deposits are eligible for deductions up to a total of Rs 1.5 lakh. That is, assuming you have opted for the previous tax structure. At present, this instrument offers an annual interest rate of 8.2 percent. That is payable on April 1, July 1, October 1, and January 1 of each quarter. The depositors risk losing between one and a half percent of the original amount in the event of an early closure.

Time deposits for five years

The terms of the national savings time deposits are one, two, three, and five years. Under section 80C, the time deposit with a duration of five years is deductible. A minimum deposit of Rs. 1,000 is needed. At the moment, it provides a 7.5 percent interest rate. The interest rate will be two percentage points lower than the rate that applies to the tenure in the event of an early closure.

Read More: CSK beat GT in yesterday’s IPL 2024 match! GT lost by 63 runs

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |