State-run bank Before the start of the new fiscal year, the Bank of India delivered a serious blow. The loan is costly because of the bank. By raising interest rates, the bank has increased the cost of lending. The EMI on current loans will rise while the cost of new loans will rise. The Bank of India (BoI) has raised its lending rate by 0.10 percent, or 10 basis points. All retail loans—home, personal, and auto loans—will increase in cost following the bank’s decision.

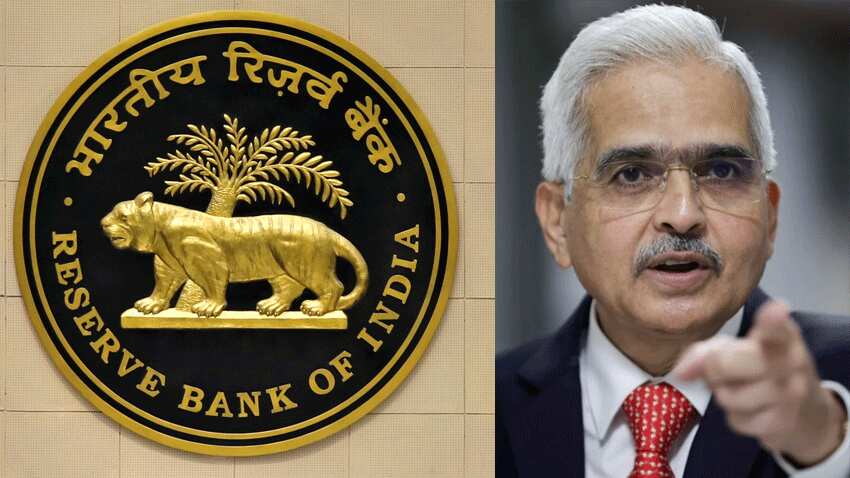

The bank raised lending costs before the RBI ruling.

The bank raised lending costs before the RBI ruling.

We would like to inform you that the Reserve Bank will be holding a review meeting to discuss its monetary policy. On April 5, the RBI will release the repo rate; nevertheless, the bank has raised the interest rates even before the announcement by the Reserve Bank. The new interest rate of the Bank of India will be effective from April 1.

How much has the debt grown in cost?

After the Bank of India raises interest rates by 10 basis points, loans will become more expensive. BOE has implemented a 0.1 percent markup’ increase. It went from 2.75 percent to 2.85 percent following this rise. The repo rate as of right now is 6.5%. The repo-based interest rate will rise to 9.35 percent in such a scenario. With an increase in interest rates, EMI will also rise.

Additionally, these banks raised the cost of borrowing.

Before the Bank of Baroda, Indian Bank, a public sector bank, also raised its benchmark prime lending rate and base rate by 0.5 percent. HDFC Bank also raised the interest rates on its home loans that were correlated with the repo rate, however, this rise was limited to newly sanctioned home loans.

Read More: Know the benefits of this battery feature that Samsung is bringing back

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |