post office time deposit scheme: Many investment possibilities have emerged as a result of the market’s shifting trends, but even today, many consumers still favour post office and bank FD plans. The term deposit scheme is the name of the post office’s fixed deposit programme. For one year, two years, three years, or five years, you can invest money in this plan. The government recently raised the interest rates on numerous small savings programmes. These include the post office time deposit scheme.

Customers getting higher interest rate

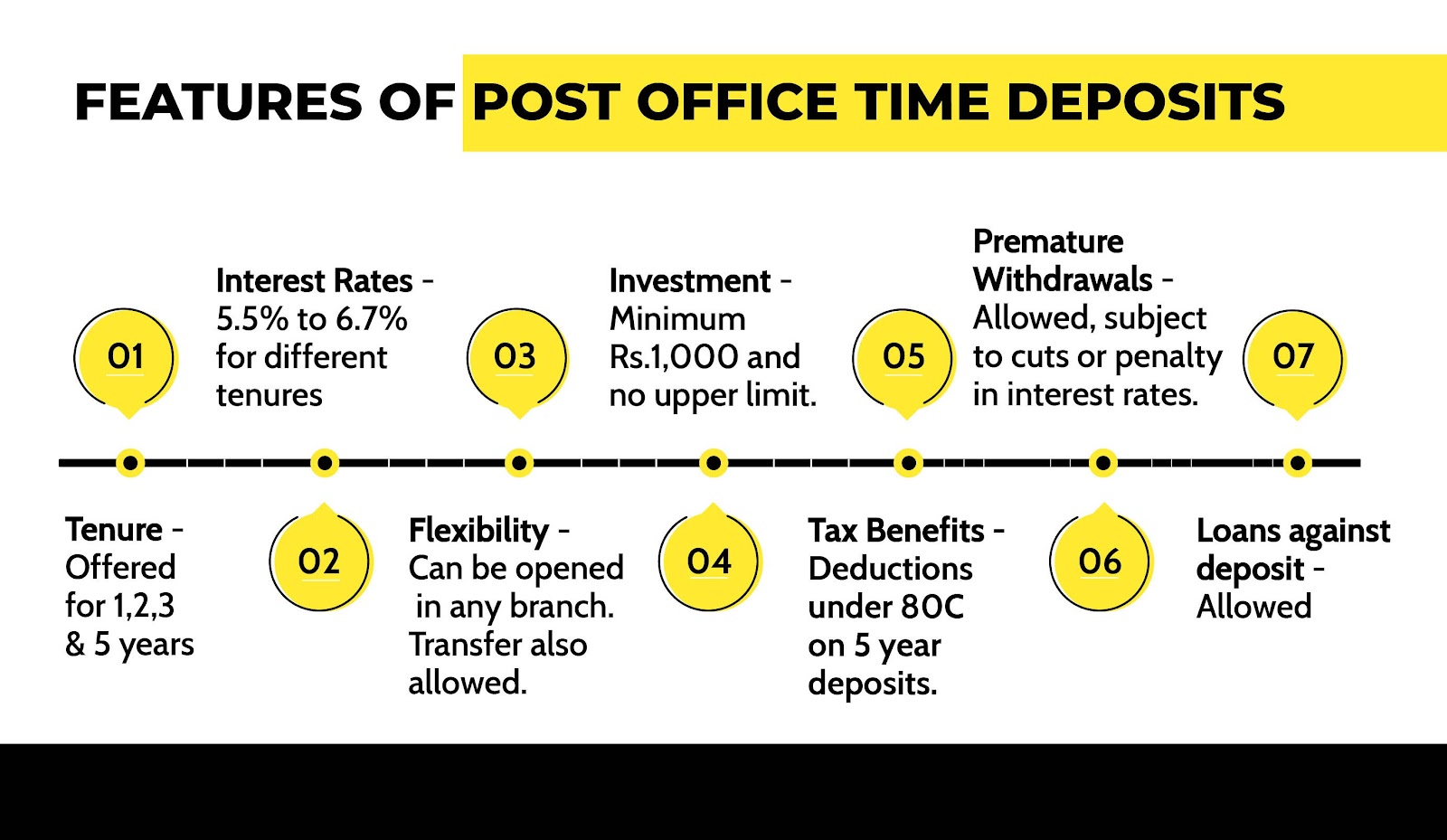

On January 1, 2023, the government raised the interest rates for the Post Office Time Deposit Scheme by 20 basis points. Following this hike, the post office’s five-year FD programme currently offers an interest rate of 7 per cent. On a one-year FD, customers receive an interest rate of 6.6 per cent. FDs with terms of two years and three years are both provided with interest rates of 6.8 per cent and 6.9 per cent, respectively.

Will benefit from a tax exemption

You can deduct Rs. 1.5 lakh from your income tax due to your 5-year investment in the scheme under Section 80C of the Income Tax Act of 1961. Additionally, you can make investments in this programme up to a maximum of 100 in accordance with your needs in multiples of Rs 1,000. The maximum investment in this is unrestricted.

The Post Office Time Deposit Scheme has the following unique features:

- You can open this account as a single account.

- This account can be opened under a joint name by two or three people.

- Under the guidance of the parents, you may open this account for a minor child (aged 10 or older).

How much interest will you get?

If you put money into the programme for five years, you will earn Rs 2,07,389 at a rate of 7%. At maturity, you will be the sole owner of the full amount of Rs. 7,07,389. In contrast, if you reinvest this sum, you will receive Rs 10,00,799 in total at maturity.

Read More: Delhi NCR Weather Predicted To Be Light Rain And Foggy

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

Google News Google News | Click Here |