The post This post office savings scheme is giving the best interest rate on Diwali 2024 appeared first on ViralPosts.

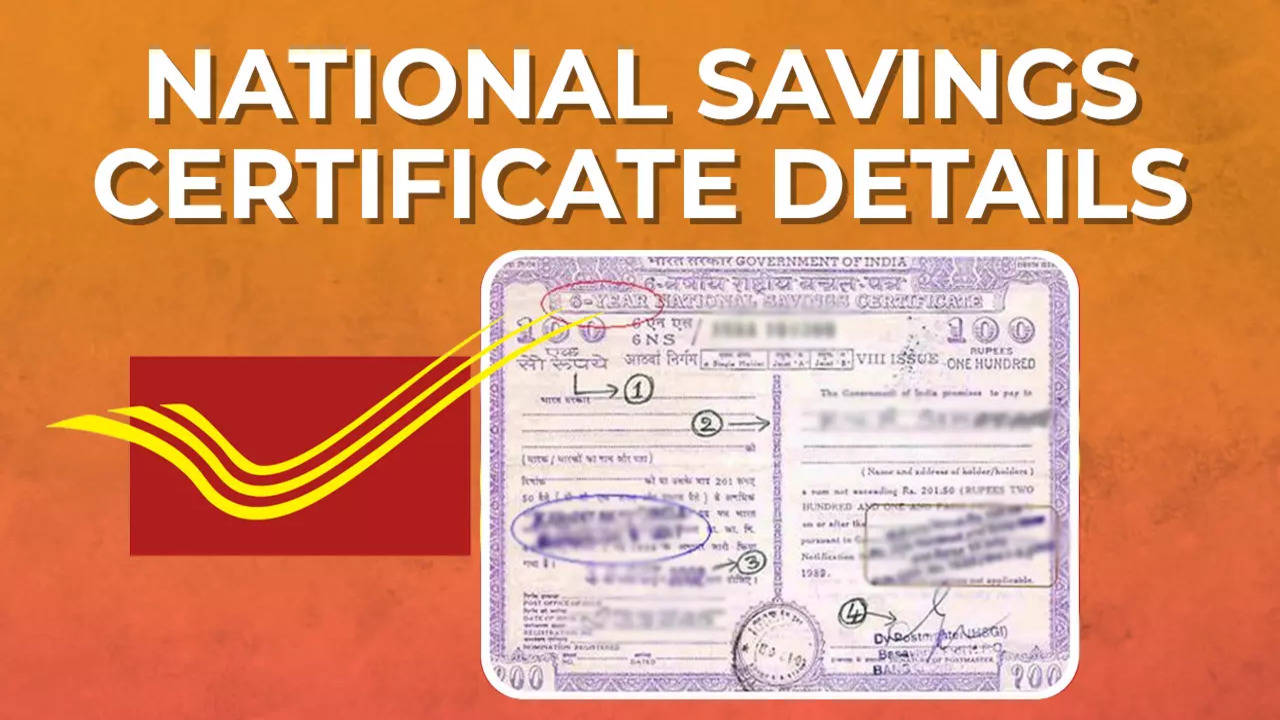

]]> A comparable small savings plan is the National Savings Certificate,

A comparable small savings plan is the National Savings Certificate,

or NSC, offered by the Post Office. After five years, you are granted a guaranteed sum under this system. Additionally, the government offers this post office savings scheme interest at a rate of 7.7 percent, compounded annually. With this plan, you don’t have to be concerned about market fluctuations in this scenario. A minimum of Rs 1000 is required to begin the scheme. The maximum deposit amount is not set. Nonetheless, multiples of 100 should be used for the deposit amount. Any number of accounts may be opened under this plan, per the information provided on India Post. Additionally, Section 80C of the Income Tax Act allows for a deduction for the deposits.

This account can be opened by whom?

Any adult or a guardian acting on behalf of a youngster or someone with a mental disability may open this account, according to the India Post website. Additionally, a kid who is older than ten years old may register an account in their own name or jointly with up to three adults.

How much will I receive in return?

A person who invests Rs 1,000 in the NSC scheme will receive Rs 449 in interest, for a total of Rs 1,449. A customer who invests Rs 10,000 in this scheme, however, will receive Rs 4,490 in interest, for a total of Rs 14,490. An individual who invests Rs 1 lakh in the NSC scheme will receive Rs 1,44,903 in total interest. However, if someone invests Rs 10 lakh, he will receive Rs 4,49,034 in interest, for a total of Rs 14,49,034.

Read More: After Diwali, these zodiac signs luck will change in terms of wealth

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post This post office savings scheme is giving the best interest rate on Diwali 2024 appeared first on ViralPosts.

]]>The post Remember this before making any PPF investments, big amount on maturity appeared first on ViralPosts.

]]> Possibility of 25-year PPF continuation

Possibility of 25-year PPF continuation

A PPF account’s maturity duration is 15 years. However, following this you can extend it in blocks of 5 years each. If you keep investing a little money in your PPF account every year for 15 years, then after 15 years you will have a good fund. After 15 years, you can close your PPF account or you can continue it for 10 years by investing 5 years each. One advantage of investing in PPF is that it offers three different kinds of exemptions. Under section 80C of income tax, you are not required to pay any taxes on the money you invest here, the interest you earn on it, or the return of your money. Aside from this, PPF is regarded as a secure investment because it is a government-backed program. This carries no danger.

How to establish a Rs 1 crore fund

PPF interest is paid annually at the end of the fiscal year. To receive the most possible benefit, you should deposit either Rs. 1,50,000 or Rs. 12,500 per month starting on April 1st of the current year. You will generate curiosity for the entire year. If you deposited Rs 1.5 lakh at the beginning of the year, then according to the current interest rate, interest of Rs 10,650 will be added to your PPF account on 31st March next year. That means next year you will have Rs 1,60,650 in your account.

18.18 lakhs in interest over 15 years

The total will be 3,10,650 rupees if you add the 1,50,000 rupees you plan to deposit for the following year to the 1,60,650 rupees already there. You will receive interest on 3,10,650 rupees, or 22,056 rupees, at the end of this year instead of 1,50,000 rupees. If you continue to deposit one lakh rupees on April 1st each year into your PPF account, after fifteen years you will have deposited twenty-two lakh rupees and will receive forty-six lakh rupees. The only interest in this will be 18.18 lakh rupees. If, after 15 years, you do not liquidate the PPF account and extend it for another five years, then your investment of Rs 30 lakh will increase to Rs 66.58 lakh. Out of this, Rs 36.58 lakh will be only interest. If you extend it again for five years (a total of 25 years), then your investment will become Rs 37.50 lakh and the interest will be Rs 65.58 lakh. In this way, in total, you will get Rs 1.03 crore.

Read More: Big offers on Flipkart! Cheapest iPhone 15 Pro will be available from 12 o’clock at night

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Remember this before making any PPF investments, big amount on maturity appeared first on ViralPosts.

]]>The post NPS Vatsalya Scheme to be launched today, this much is investment limit appeared first on ViralPosts.

]]> The NPS Vatsalya Scheme

The NPS Vatsalya Scheme

is open to all nationals who wish to invest in their child. The child can carry out the plan as an adult if he so chooses. The parents or legal guardians of the child may also participate in this plan. The Pension Fund Regulatory and Development Authority (PFRDA) will oversee the operation of this plan. Any parent can choose from several investment possibilities when they contribute to their children’s NPS Vatsalya Yojana. The government has given its approval to each of these investment choices. There are four ways to invest in NPS Vatsalya, according to the Central Bank of India website.

According to the Central Bank of India website,

you would need to invest a minimum of Rs 1000 a year if you wish to invest in the NPS Vatsalya Yojana for your child. However, you are free to invest as much money as you like if you would like to. In other words, its maximum limit is infinite. You will need to wait three years from the date of investment if you would like to take money out of the funds you have invested in your child’s name. You are then able to take out a maximum of 25% of the funds. You can take out this money for any kind of medical treatment or schooling. In addition, if a person is disabled for more than 75% of the time, they can withdraw money. Until your child becomes eighteen, you can repeat this three times.

When your child turns eighteen,

When your child turns eighteen,

you can withdraw your investment from the NPS Vatsalya Yojana if you made it in their name. If the child’s account balance is Rs 2.5 lakh or less, you can take the full amount out the amount in one go. But if it is more than Rs 2.5 lakh, then you can withdraw 20% of the money in one go. With the remaining money, you can buy an annuity for regular income. From which you will get some money every month.

Read More: IBPS RRB PO Prelims Result 2024 is out, you can check like this

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post NPS Vatsalya Scheme to be launched today, this much is investment limit appeared first on ViralPosts.

]]>The post Government to take big decision on PPF-Sukanya Samridhi before budget appeared first on ViralPosts.

]]>

For a considerable amount of time, the PPF interest rate has been 7.1%.

It is important to note that the government monitors interest rates on savings programs such as RD, PPF, Kisan Vikas Patra, NSC, Sukanya Samriddhi Yojana, Mahila Samriddhi Savings Certificate, and Senior Citizen Savings Scheme (SCSS) every quarter. This time the budget is expected to be presented on 22 July. If the interest rate is increased by the Finance Ministry, it will be a big gift for the middle class before the budget. The interest rate of PPF has remained at 7.1 percent per annum for a long time.

People will save more money if interest rates rise.

People will save more money if interest rates rise.

Increasing interest rates, according to financial experts, will motivate consumers to save more money. However, the government will need to think about raising interest rates. It is said that for the past few years, the interest rate on small savings plans has stabilized. However, the government must first determine whether or not it can afford to pay higher interest rates. The country may suffer losses on the international front if the government raises interest rates excessively. It is anticipated that the government will progressively raise interest rates in such a scenario.

The 8.20 percent SSY interest rate was raised.

The 8.20 percent SSY interest rate was raised.

The interest rates of the two schemes were modified by the government for the final quarter of the fiscal year 2023–2024. At that point, Sukanya Samriddhi Yojana (SSY) interest rates were raised from 8% to 8.20%. The three-year fixed-rate loan (FD) interest rate was raised by the government to 7.1 percent. Nonetheless, for the past four years, the PPF interest rate has stayed constant. The PPF interest rate was last modified in April or June of 2020. It decreased to 7.1 percent during the Corona pandemic from 7.9 percent. There was no alteration in it after that.

Small savings schemes and the interest rate on them

- PPF is currently getting an interest rate of 7.1% per annum.

- SCSS – Senior Citizen Savings Scheme is getting an interest rate of 8.2%.

- The amount deposited under Sukanya Samriddhi Yojana is getting an interest rate of 8.2%.

- National Savings Certificate is getting an interest rate of 7.7%.

- Post Office Monthly Income Scheme is currently getting an interest rate of 7.4%.

- Kisan Vikas Patra (KVP) is getting an interest rate of 7.5%.

- The interest rate on 1-year deposits is 6.9%.

- The interest rate on 2-year deposits is 7.0%.

- The interest rate on 3-year deposits is 7.1%.

- The interest rate on 5-year deposits is 7.5%.

- The interest rate on 5-year RD is 6.7%.

Read More: Whatsapp to stop working on these 35 smartphones! know the details

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Government to take big decision on PPF-Sukanya Samridhi before budget appeared first on ViralPosts.

]]>The post Government changed PPF-Sukanya Samriddhi rules! New rules will apply from 1 April appeared first on ViralPosts.

]]>

This notification will take effect in three days.

As they were for the fourth quarter of the fiscal year 2023–2024. Interest rates for the first quarter of the upcoming fiscal year will not change from 1 January 2024 to 31 March 2024). According to the notification issued by the Finance Ministry. An interest rate of 8.2 percent will be available on the amount deposited under the Sukanya Samriddhi Scheme. It will remain the same as before. Apart from this, the interest rate on a three-year FD will remain at 7.1 percent as before.

Why was the choice made?

The investment has 115 months to mature. In addition, the interest rates for the Post Office Savings Plan (POSS), which is favored by millions of investors, and PPF will stay unchanged at 4.1 percent and 4 percent, respectively. Additionally, the 7.5 percent interest rate on Kisan Vikas Patra has been sustained. The maturity period of an investment in this government program is 115 months. Other than this, the 7.7 percent interest rate on National Savings Certificates (NSCs) will not change for the April–June 2024 quarter.

Investors will continue

to receive the 7.4% interest rate on the Monthly Income Scheme, just like they did this quarter. Every quarter, the government announces the interest rate on small savings plans based on review. These plans are mainly operated by the post office.

Read More: Suzuki launched a new bike with a 776cc engine & cost Rs 10.30 lakh

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Government changed PPF-Sukanya Samriddhi rules! New rules will apply from 1 April appeared first on ViralPosts.

]]>The post On April 1, these rules for NPS will be changed! PFRDA made these 5 big changes appeared first on ViralPosts.

]]>

NPS will begin using two-factor authentication on April 1.

NPS customers will need to use their mobile device’s OTP and UID verification to log in. The NPS account will be kept more secure as a result of this. At the moment, accessing the account requires both a user ID and a password. Changes of any kind are possible only after logging in through them.

The PFRDA modified the withdrawal guidelines on February 1.

The NPS account holder is not permitted to withdraw more than 25% of the entire amount deposited under the new regulations. This will contain the employer’s and the account holder’s respective contribution amounts. This means that you won’t be able to take partial withdrawals from your NPS account if you currently own a home.

Additionally, PFRDA modified the guidelines for cash withdrawals.

The new regulation allows NPS customers to take out little, regular payments rather than a large, flat sum from their investments. You may take out the maturity amount as often as you’d like under this rule—monthly, quarterly, half-yearly, or annually. Before now, the rule was that you could withdraw 60 percent of the amount deposited in NPS at one go. But it was necessary to buy an annuity plan for pension with the remaining 40 percent amount.

PFRDA had previously altered the guidelines for cash withdrawals.

The new regulations state that to withdraw money, you must have certain documentation. The recipient’s pension may be terminated if he fails to upload the required paperwork or if there is any inconsistency discovered. Before anything else, you need to confirm that you have uploaded the NPS withdrawal form. In addition, a copy of your PRAN, or Permanent Retirement Account Number card, and verification of your bank account should be with you. To streamline the withdrawal process for NPS subscribers, PFRDA had previously eliminated the requirement to fill out a separate proposal form to choose an annuity after leaving the pension fund the previous year. The Pension Board made it clear that the withdrawal form filed by the NPS subscribers will be considered as an annuity proposal.

Read More: BCCI to give Rs 1 crore annually to Sarfraz Khan & Dhruv as a part of central contract

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post On April 1, these rules for NPS will be changed! PFRDA made these 5 big changes appeared first on ViralPosts.

]]>The post Deposit money in PPF, SSY & NPS accounts by March 31 to avoid potential penalties! appeared first on ViralPosts.

]]>

March 31, 2024, is the deadline

for depositing the minimum amount into your Sukanya Samriddhi, NPS, and PPF accounts for the current fiscal year. The administration has made the new tax structure more alluring in the 2023 budget. Under the new tax regime from April 1, 2023, the income tax slab was changed and the basic exemption limit was increased from Rs 2.5 lakh to Rs 3 lakh in a financial year. Apart from this, standard deduction is also available in the new tax regime. Under this, you do not have to pay any tax on income up to Rs 7 lakh.

If the required minimum deposit is not made, there could be a fine.

In this case, it’s plausible that you chose to pay your taxes under the new tax regime for the current fiscal year 2023–2024. In this case, you will receive savings like PPF, Sukanya Samriddhi Yojana (SSY), and NPS annually if you invested in small savings plans and paid taxes under the previous tax system through the end of the financial year. will need to contribute to the plan. You will not receive the benefit of tax exemption on investments made in certain savings programs, even if you choose the new tax system. Failing to deposit the required minimum in each of these accounts may also result in a fine.

How much cash must be deposited into PPF?

Every financial year, a minimum of Rs. 500 must be deposited into the PPF account, as per the 2019 PPF Rules. The PPF account will become inactive if the required minimum is not deposited. When an account is dormant, there are no loan or withdrawal options accessible. An inactive account can be reactivated before its maturity. In the event of an account default, a fee of Rs 50 is imposed annually. In addition to the default fee, the depositor must make an annual minimum deposit of Rs 500. An annual minimum deposit of Rs 500 must be made into this account each year.

Another tax-saving investment option for people

looking to save for a girl child is the Sukanya Samriddhi Yojana. The SSY system stipulates that account holders must deposit a minimum of Rs 250 each financial year. A Sukanya account is regarded as a default account if a minimum of Rs 250 is not deposited in the account within a financial year. Any default account may be revived at any point before maturity under the scheme’s rules. For each year of default, there is a Rs 50 fee to reinstate the account.

NPS

NPS

Certain taxpayers utilize Section 80CCD(1B) of the Income Tax Act to invest an extra Rs 50,000 and register an NPS account to save taxes. An investment of Rs 50,000 is permitted under Section 80C, up to a maximum of Rs 1.5 lakh. Every individual is required under NPS regulations to make a minimum deposit of Rs 1,000 each fiscal year. However, if your account is dormant, you can fund it with a Rs. 500 deposit to make it active. However, it’s crucial to remember that you must deposit a minimum of Rs 1000 during a fiscal year.

Read More: Recruitment for Junior Executive positions is being accepted by Airport Authority of India

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Deposit money in PPF, SSY & NPS accounts by March 31 to avoid potential penalties! appeared first on ViralPosts.

]]>The post Important update: PPF-Sukanya Samriddhi accounts will be blocked as of October 1 appeared first on ViralPosts.

]]>

Time for investors until September 30th

The Finance Ministry has given investors till September 30th to do this. If you disregard the Finance Ministry’s demand, your account will be free as of October 1. Investors would be required to furnish PAN and Aadhaar for KYC for all modest savings plans, including PPF, Sukanya Samriddhi Yojana (SSY), Post Office Scheme, and Senior Citizens Saving Scheme, according to a notification released by the Finance Ministry. It is essential. Before, investments could be conducted under Central Government regulations even without having an Aadhaar.

PPF Update – In 2015, the Sukanya Samriddhi Yojana was launched

You can invest using your Aadhaar enrollment number even if you haven’t created an Aadhaar yet. The announcement makes it quite clear that PAN cards must be provided for investments that exceed a specific threshold. In 2015, the Modi administration launched the Sukanya Samriddhi Yojana. Prior to the government notification, Aadhaar was not required to invest in this programme. However, the law has since been modified. PAN cards or Form 60 must be supplied when creating an account under a programme like Sukanya Samriddhi, according to Finance Minister Nirmala Sitharaman. If you are unable to submit your PAN at that time, you have two months to do so.

Which plans are subject to the rule?

- Post Office Monthly Income Scheme (POMIS)

- Post Office Fixed Deposit (FD)

- Post Office Recurring Deposit (RD)

- Post Office Time Deposit (TD)

- Sukanya Samriddhi Yojana (SSY)

- Certificates of Savings Mahila Samman

- PPF, or Public Provident Fund

- Kisan Vikas Patra (KVP)

- Senior Citizens Savings Scheme (SCSS)

Read more: LIC is currently providing a discount of Rs. 4000 on this sort of policy as part of a special offer

![]()

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Important update: PPF-Sukanya Samriddhi accounts will be blocked as of October 1 appeared first on ViralPosts.

]]>The post Now no worries for daughter’s education till marriage, under this scheme you’ll receive Rs.64 lakh on maturity appeared first on ViralPosts.

]]>

A modest savings programme is the Sukanya Samriddhi Yojana

Every three months, the central government sets the interest rate for these programmes. The interest rate for this programme has not changed by the government for the quarter from July to September 2023. At the moment, interest is paid out at a rate of 8% annually.

Now is the time to open the account

It is only appropriate to register a Sukanya Samriddhi account once the daughter is born. Up until the daughter is 10, the account can be opened. If the account is started as soon as the daughter is born, the investor can make contributions for 15 years, and when the daughter reaches adulthood, they can withdraw 50% of the maturity amount. When the daughter reaches the age of 21, the balance can be withdrawn.

Sukanya Samriddhi Yojana – Daughter will receive 64 lakhs

If you put Rs 12,500 per month into your Sukanya Samriddhi account, you will have put in Rs 1.5 lakh over the course of a year. If the interest rate at maturity is also taken into account, it will be 7.6 percent, thus the daughter will have a sizeable sum available till maturity.

The maturity amount will be Rs 63, 79, 634

if the entire sum is withdrawn when the daughter reaches 21; the amount invested would be Rs 22,50,000. In this method, your daughter will receive approximately Rs 64 lakh when she reaches 21 if you make a monthly payment of Rs 12,500 into her Sukanya Samriddhi account.

This plan will reduce taxes as well

With this programme, investors can receive income tax exemptions on investments up to Rs 1.50 lakh each year. Deposits are limited to Rs 1.5 lakh per calendar year. In accordance with this plan, interest is also tax-free. The maturity amount is also tax-free at the same time.

Read more: ITR filing: Govt gave this benefit & received this exemption on income tax

![]()

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Now no worries for daughter’s education till marriage, under this scheme you’ll receive Rs.64 lakh on maturity appeared first on ViralPosts.

]]>The post Your daughter will receive 15 lakh from SBI, she can use it for both her wedding and studies appeared first on ViralPosts.

]]>

According to SBI

the Sukanya Samriddhi Yojana provides daughters with the whole sum of Rs 15 lakh. This money might be used for marriage or for your schooling.

The SBI bank tweeted information regarding this.

According to SBI, the bank offers girls the Sukanya Samriddhi Scheme, in which you may turn your daughter into a millionaire by making a just Rs 250 deposit.

The benefit of a guaranteed income is

what makes this government program unique. You will additionally benefit from a tax exemption in addition to this. This program is especially for young girls. The government offers this program’s facility in order to ensure the future of females.

In addition, the government is currently providing

the benefit of interest on the Sukanya Samriddhi Scheme at a rate of 8%. In addition, you can use this plan for two daughters. On the other hand, if the couple has two further twin daughters after the first, then all three children will be eligible for this government program. This account can be opened for a maximum of 15 years. You must pay a penalty of Rs. 50 if you don’t deposit the plan’s payments on time.

Read more: Jan Aushadhi Kendra, you also apply for this at Rs 5000, it will provide you 50,000 monthly

![]()

| |

Facebook Page Facebook Page | Click Here |

Twitter Twitter | Click Here |

Instagram Instagram | Click Here |

The post Your daughter will receive 15 lakh from SBI, she can use it for both her wedding and studies appeared first on ViralPosts.

]]>