There are several ways to handle your money if you find yourself in a financial bind. In addition to credit cards, personal loans, and gold loans can also be used to meet your demands from banks. You should manage finances by remembering that the interest rate on the loans you are taking out shouldn’t be excessively high. It might be something you can use as necessary, but over time, it might cause issues. Here are some things to consider if you ever need to take out a personal loan from banks. We’ll explain to you how to get a low-interest personal loan and what considerations you should make before applying.

Maintain credit score

Your strong credit score is the primary factor used to approve your loan. Banks that issue loans evaluate a person’s ability to repay the loan based on this score. A history of on-time loan and credit card repayment is reflected in an excellent credit rating. Thus, to qualify for a loan with favorable terms, you should concentrate on keeping up a strong credit score.

Compare the banks that offer loans

You should evaluate various loan-granting banks and their loan offerings before applying for an online loan. When you have several possibilities, you should evaluate the lenders according to terms and conditions, loan amount, interest rate, and processing charge. By using a comparison analysis, the borrower can make an informed decision that best suits his needs and financial situation.

Loan Casting

Personal loans may have extra costs in addition to the principal amount, such as processing fees, prepayment penalties, and late payment penalties. Before choosing which bank to accept a loan from, you should thoroughly research each one’s policies. You will be able to evaluate the effects of taking out and repaying a personal loan with accuracy if you do this.

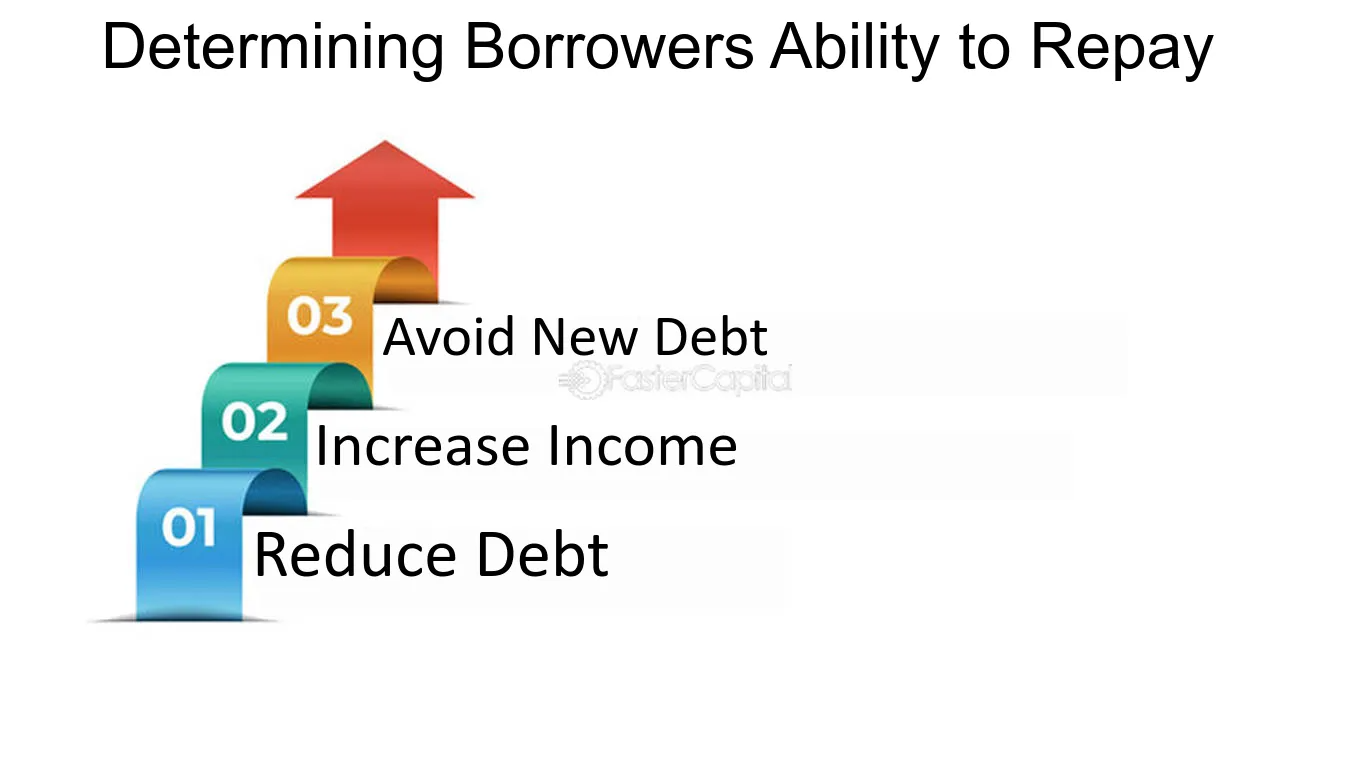

Ability to Repay

Before taking out a personal loan, the applicant needs to assess his capacity for payback. This involves estimating their monthly income, cutting down on necessary spending, and determining how much money is left over to pay back the loan. By taking into account the loan terms and conditions in addition to his financial situation, the borrower should assure repayment without placing undue burden on his financial capacity. Apart from this, your credit history significantly affects the loan terms and eligibility. Making timely payments increases your credibility in the eyes of the bank and opens the way for better loan offers for you.

Read More: SBI to stop giving high-interest rates on these schemes after 31 March

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |