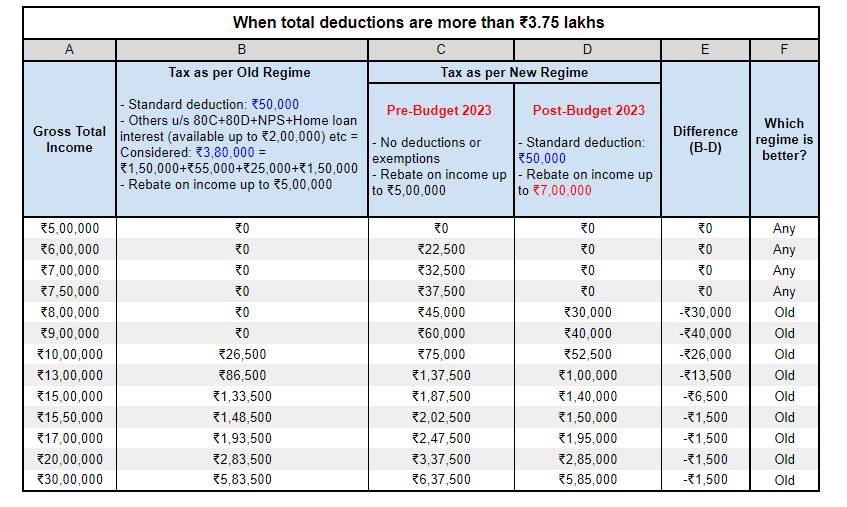

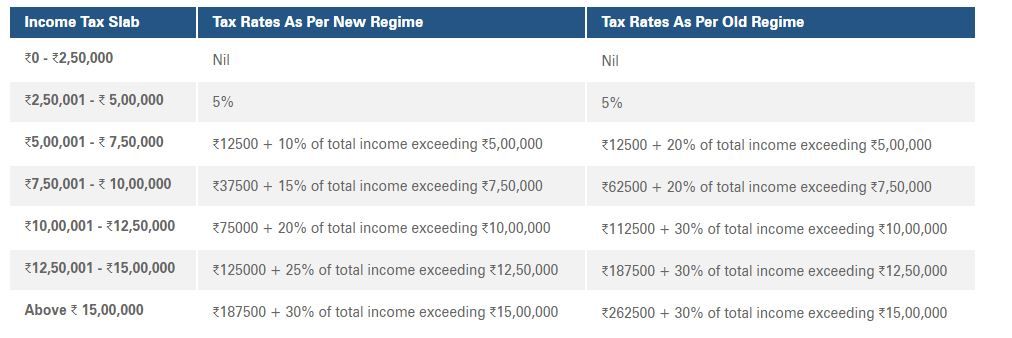

In the budget, Finance Minister Nirmala Sitaran offered taxpayers the choice of a new tax system. This gave those in employment two choices for submitting tax returns. You will automatically be placed in the new tax system if you do not select the old one. While there is no tax exemption on savings and investments under the new tax regime, there was under the Old Tax Regime that you may take advantage of to save taxes on savings and investments. People are asking themselves a lot of questions about whether to choose the Old Tax Regime or the new tax structure. People are curious as to which choice is best for them.

It is possible to save up to Rs 52,000

in taxes, if you continue to use the previous tax structure and make wise investments, advise tax experts. You must notify your company to continue under the previous tax regime. Select the previous tax regime if you rent an apartment, have taken out a loan, have a savings plan, or have health insurance, as there is no tax exemption on investments, savings, or anything else under the new tax regime. You were eligible for house loans, education loans, and HRA claims under the previous tax system; under the new one, you are not.

How to Reduce Your Taxes

You can save up to Rs. 52,000 in taxes if you invest in a pension plan under the previous tax regime and choose NPS benefits on the company’s behalf. Let’s use an example to better grasp this. Assume for the moment that you get paid Rs 15 lakh 36 thousand. In addition to the reimbursement portion, investing in NPS with funds from Rs. 21600 in PF, Rs. 12000 in ELSS, and Rs. 14000 in LIC can result in greater tax savings. Employers are permitted to pay 10% of an employee’s salary to NPS under 80CCD(2). You can receive an additional 10% of your salary, tax-free, if you select this option. If your business allocates Rs. 4,000 from employee salaries in NPS, then your tax will be reduced by about Rs 10000. If you want, you can also invest up to Rs 50 thousand in NPS under 80CCD (1b). By doing this you can save around Rs 10400 more.

Savings on taxes under 80C

Likewise, to qualify for tax benefits under section 80C, you must demonstrate that you have spent around Rs 2 lakh in this category if you pay Rs 1 lakh 20k for rent, Rs 60k for an education loan, and Rs 23500 for health insurance. This implies that you can save up to Rs 30,000 in taxes if you claim a full deduction under section 80C of up to Rs 1.5 lakh. In the previous tax system, you might have saved up to Rs 50,000 in taxes in this way.

Read More: Railways updated the merit list of the 1664 chosen applicants

|

|

Facebook Page Facebook Page |

Click Here |

Twitter Twitter |

Click Here |

Instagram Instagram |

Click Here |